Annual Report and Financial Statements 2016

ARCHITECTS REGISTRATION BOARD

ANNUAL REPORT AND FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2016

PERFORMANCE REPORT

Overview

Statement of the Registrar & Chief Executive, Karen Holmes, on the performance of the Architects Registration Board in 2016.

Purpose and activities of the Architects Registration Board (ARB)

ARB is a statutory body established by Parliament under the Architects Act 1997 (the Act) to regulate the architects profession in the UK.

Under the provisions of the Act, ARB’s statutory functions include:

- Prescribing – or ‘recognising’ – the qualifications needed to become an architect

- Keeping the Register of Architects

- Issuing a Code of Conduct for architects

- Investigating allegations of unacceptable professional conduct and serious professional incompetence against architects

- Regulating the title ‘architect’

- Act as the UK’s Competent Authority for architects

ARB’s two strategic aims, which sit under its statutory responsibilities, are:

- Protecting the consumer

- Supporting architects through regulation

A Board of 15 members, seven of whom are architects elected by the profession, and the remaining eight being non-architects appointed by the Privy Council, oversees the work of ARB.

ARB has a permanent staff of 23, including an executive team of five.

The work of ARB is largely delivered through a number of committees. Further information on our committee structure is found detailed within the Governance Statement.

Risks in delivering ARB’s objectives

ARB has in place a risk management strategy, which is reviewed and updated annually. The strategy specifies how ARB identifies, assesses and manages the risks which may impact on ARB’s delivery of its strategic aims. The strategy has six principles which underpin ARB’s approach. As a statutory body, ARB is naturally risk-averse as risk is often seen in financial terms as having an adverse impact on ability to deliver. ARB works to minimise and control risk by taking an appropriate and proportional approach to it.

A number of key risks have been identified that could affect ARB’s ability to deliver its objectives being:

Periodic Review

The key risk during 2016 was the impact the on-going, Periodic Review had on ARB’s ability to fulfil its statutory obligations effectively as well as having to defer a number of projects. This uncertainty created the potential for the credibility of ARB to be undermined.

Capacity Risk

The uncertainty created by the delayed outcome of the Periodic Review created significant human resource risks. However, the organisation continued to successfully deliver its statutory functions. Alongside the on-going challenges that the delayed Periodic Review presented, 2016 saw a continued increase in the number of new applications received from architects wishing to join the Register. The increase in workload in the area of registration and other areas within the organisation created a heightened capacity and resource risk during 2016. This was mitigated by the use of temporary resources, use of professional advisors and a committed flexible workforce which enabled the organisation to continue to deliver its statutory functions during a period of increased demand. In November 2016 the Board increased the maximum permanent staff headcount from 22 to 23 members of staff.

Legal Challenge

There continues to be an ongoing risk in respect of judicial review or legal action in respect of decisions taken by the Board, the Registrar or the Professional Conduct Committee. During 2016 an appeal against a decision of the Professional Conduct Committee was successfully defended. Rather than being an unexpected risk, it is accepted that, as a regulator that ARB could face challenges to the decisions it makes through the course of its business. Those challenges can be costly and create reputational risk, but robust procedures are in place to ensure that decisions are reached fairly and in line with the law. Appropriate insurance arrangements are in place to mitigate the financial risks arising from legal challenge.

Performance Summary

The strategic aims of ARB are reflected through specific objectives, which are set out in the annual Business Plan. The success in delivering those objectives is judged against Key Performance Indicators (KPIs) and measurable targets.

The on-going performance of ARB against those objectives is reported twice a year to the Board, and published in an annual report early in the subsequent year.

In summary, the performance of ARB in 2016 was good. Most objectives for the year were met other than those which had to be postponed pending the outcome of the Periodic Review, and plans were put in place to address the areas in which performance can be improved in 2017. There were no areas in which performance was unacceptable. Further details can be found in the Performance Analysis below.

Performance Analysis

Measures of performance

ARB measures its performance in two ways:

- Delivery of objectives against the annual Business Plan

- Delivery of core-work against agreed Key Performance Indicators

Delivery of objectives against the Business Plan

In 2016 there were 28 objectives set out in the Business Plan. Success in the delivery of these objectives is assessed via a traffic light system. 21 of the objectives were fully delivered, while three objectives had to be deferred due to the on-going Periodic Review. There were four objectives that were partially delivered or delivered with only partial success.

The full breakdown of the delivery of ARB’s objectives can be found in ARB’s 2016 Report against the Business Plan, published on the organisation’s website http://www.arb.org.uk/about-arb/arbs-board-committees/board-meetings/board-meetings-2017/february-agenda-16-02-2017/

In summary:

|

ARB has successfully delivered the item of work to a satisfactory standard |

|

ARB delivered the majority of the item or delivered only with partial success |

|

ARB has not delivered the item or performance has been unsatisfactory |

|

No outcome due to Periodic Review so item of work undeliverable |

Delivery of core-work against agreed Key Performance Indicators

The Board has set Key Performance Indicators by which the organisation has to perform in relation to its core activities. On-going performance is reported biannually both statistically and using the traffic light system.

ARB’s performance has generally improved from the previous year; this is notable because of the increase in workload in some areas and a continued growth in the number of architects on the Register, which is larger than ever before.

| Performance indicator | Target for 2016 | Performance | Traffic light |

Maintaining the quality of the Register |

|||

| UK route registration-no. of days to process | 90% within 15 (working) days | 93% (96% in 2015) | |

| Automatic European route registration- no. of days to process | 90% within 15 (working) days | 84 % (82% in 2015) | |

| Reinstatements & Readmissions within 2 years | 90% within 5 (working) days | 93% (90% in 2015) | |

Maintain the standard of conduct and practice of architects |

|||

| Complaints in office – No. of weeks from date of receipt to IP referral or closure | 80 % within 16 weeks | 86% (94% in 2015) | |

| Complaints with IP – No. of weeks from referral of case to issue of final decision | 80 % within 12 weeks | 81% (81% in 2015) | |

| PCC Reports – No. of weeks from referral to production of Board solicitor’s Report | 80 % within 12 weeks | 64% (71% in 2015) | |

| PCC Hearing date – No. of weeks from receipt of Board solicitor’s Report to PCC hearing | 80 % within 16 weeks | 68% (91% in 2015) | |

Maintain the standard of conduct and practice of architects |

|||

| Title complaints in office – No. of weeks from date of receipt to referral to Board’s solicitor or closure | 80 % within 16 weeks | 91% (90% in 2015) | |

| Title complaints with Board’s solicitor to conclusion–No. of weeks from date of referral to non-prosecution conclusion/ summons | 80 % within 12 weeks | 71% (71% in 2015) | |

Signed by

Karen Holmes, Registrar and Chief Executive (Accounting Officer)

12/05/2017

ACCOUNTABILITY REPORT

Corporate Governance Report

Board Report

| Administration Office 8 Weymouth Street London W1W 5BU |

Bankers National Westminster Bank Plc 125 Great Portland Street London, W1A 1GA |

Auditors Crowe Clark Whitehill LLP St Bride’s House 10 Salisbury Square London, EC4Y 8EH |

Board Chair – Beatrice Fraenkel was Chair of the Board to 14 July 2016. Peter Coe was elected Chair of the Board from 15 July 2016 onwards until 16/02/17. Nabila Zulfiqar was elected Chair with effect from 16 March 2017.

Leadership – Karen Holmes was Registrar and Chief Executive throughout 2016.

Board Membership 2016

| Carol Bernstein | Appointed (From 01/08/16) | John Assael | Elected (Retired 31/03/16) |

| Peter Coe | Appointed | Jason Bill | Elected (From 01/04/16) |

| Beatrice Fraenkel | Appointed (Retired 31/07/16) | Ruth Brennan | Elected (Retired 31/03/16) |

| Alan Jago | Appointed | Hans Eisner | Elected (Retired 31/03/16) |

| Myra Kinghorn | Appointed (Retired 31/03/16 | Guy Maxwell | Elected (From 01/04/16) |

| Ros Levenson | Appointed | Andrew Mortimer | Elected (Retired 31/06/16) |

| Suzanne McCarthy | Appointed (From 01/04/16) | Richard Parnaby | Elected (Re-elected 01/04/16) |

| Jagtar Singh | Appointed (From 01/04/16) | Susan Roaf | Elected (From 01/04/16) |

| Neil Watts | Appointed | Danna Walker | Elected (From 01/04/16) |

| Nabila Zulfiqar | Appointed | Susan Ware | Elected (Re-elected 01/04/16) |

| Alex Wright | Elected (Re-elected 01/04/16) |

Chairs of Committees

| Committee | Chair |

| Audit Committee | Myra Kinghorn (Until 31/03/16)

Suzanne McCarthy (From 01/04/16) |

| Investigation Oversight Committee | Nabila Zulfiqar |

| Prescription Committee | Alan Jago |

| Remuneration Committee | Alan Jago |

Declaration of Interests

All Board members submit an annual declaration for inclusion within the Board’s Register of Interests. Details of the most recent declarations are published with individual Board members’ details on ARB’s website, http://www.arb.org.uk/about-arb/arbs-board-committees/board-members/

The Register of Interests is brought to each Board meeting, and Board members are required to declare any interest they may have in any of the Boards business on the agenda, prior to the discussion of that item taking place. Declarations are recorded in the minutes.

Information Security and Data Handling

Due to our statutory functions, we hold a large amount of data some of which constitutes personal data. We have in place relevant procedures to ensure data is handled appropriately at all times. In 2016 a complaint was made to the Information Commissioner about ARB’s response to a request for information under the Freedom of Information Act 2000. The Information Commissioner upheld ARB’s handling of the request.

Equality and Diversity

The Board receives an annual progress report on Equality and Diversity. This report was presented to the Board in November 2016. In February 2017, a breakdown of the Equality and Diversity data collected was presented to the Board. The Board Equality Scheme and agreed actions have been updated to take account of the Public Sector Equality duty to which ARB, as a public body, is subject.

Many of the aims identified in the Scheme have become firmly embedded in the Board’s work and in the work of ARB more generally. As a public body, ARB abides by the Public Sector Equality Duty, which requires public bodies to:

- eliminate unlawful discrimination, harassment, victimisation and any other conduct prohibited by the Act;

- advance equality of opportunity between people who have a protected characteristic and those who are not; and

- foster good relations between people who share a protected characteristic and those who don’t.

The Board considers all of these requirements in any decision-making process, and any equality implications are identified and taken into account before decisions are made. All of those who provide a service on behalf of ARB will have received training on the Equality Act and its importance to ARB’s functions.

Environmental/Recycling

ARB is committed to reducing the impact on the environment through recycling, and the organisation uses different receptacles for collecting and segregating recyclable and non-recyclable waste.

During 2016 we saved the equivalent 81 trees (75 in 2015) by recycling and 4,740 kilos of paper (4,365 in 2015). The volume of printing increased during 2016 by 9% and the amount recycled increased by 8%. The increase in recycling was due to the increase in printing. We continue to be committed to moving further services online with electronic means of communication as the default option where possible.

To help reduce emissions, computers are powered down when not in use, computer monitors switched off at night, lights are turned off at night, some rooms have been fitted with sensor switches to ensure light are only on when room is in operation and heating is zoned and timed.

Employee involvement

The “one ARB” ethos continues to be cultivated throughout the organisation. We have a set of commitments, which provide a focus for each aspect of the work we do, and we continue to embed these further into our work, which is supported through all staff training events. At the end of 2016 we carried out a staff engagement survey, the outcome of which was sufficiently positive that the overall conclusion drawn from the results was that ARB had an engaged workforce.

Health and Safety

There have been no health and safety incidents reported during the year. All the statutory checks and tests have been undertaken and classified as complete.

Approved and signed on behalf of the Board

Nabila Zulfiqar

12/05/2017

Statement of Accounting Officer’s Responsibilities of the Board and the Accounting Officer in respect of the financial statements

Under the Framework agreement drawn up jointly between the Architects Registration Board and the Department for Communities and Local Government (DCLG), the Architects Registration Board will prepare financial statements for each financial year in the form and on the basis set out in the Accounts Direction issued by the DCLG. The financial statements are prepared on an accruals basis and must give a true and fair view of the state of affairs of the Architects Registration Board and of its income and expenditure, recognised gains and losses and cash flows for the financial year.

In preparing the financial statements, the Accounting Officer is required to comply with the Government Financial Reporting Manual and in particular to:

- observe the Accounts Direction issued by the Department for Communities and Local Government, including the relevant accounting and disclosure requirements, and apply suitable accounting policies on a consistent basis;

- make judgements and estimates on a reasonable basis;

- state whether applicable accounting standards as set out in the Government Financial Reporting Manual have been followed, and disclose and explain any material departures in the financial statements; and

- prepare the financial statements on a going concern basis.

The DCLG has appointed the Registrar as Accounting Officer of the Architects Registration Board. The responsibilities of an Accounting Officer, including responsibility for the propriety and regularity of the public finances for which the Accounting Officer is answerable, for keeping proper records and for safeguarding the Architects Registration Board’s assets are set out in Chapter 3 of Managing Public Money published by the Treasury.

As the appointed Accounting Officer I confirm that, as far I am aware, there is no relevant audit information of which the entity’s auditors are unaware, and that I have taken all the steps to make myself aware of any relevant audit information and to establish that the entity’s auditors are aware of that information. I also confirm that the annual report and financial statements as a whole are fair, balanced and understandable, and that I take personal responsibility for the annual report and financial statements and the judgments required for determining that they are fair, balanced and understandable.

Signed by

Karen Holmes, Registrar and Chief Executive (Accounting Officer)

12/05/2017

Governance Statement

As Accounting Officer of the Architects Registration Board (ARB), I, Karen Holmes, am responsible for the management and control of the operations of ARB and the efficient use of our resources. The Board and my colleagues within ARB support the role. This Governance Statement identifies how I discharge the responsibilities. The Statement outlines the governance of the organisation and the risk management framework, which are essential to managing and controlling ARB’s resources and risks. It reflects the challenges and activities of ARB during the year and provides assurance as to performance, responses to risk and the organisation’s success in managing risk. The statement also identifies where ARB will be taking steps to improve.

Corporate Governance

The Board provides the strategic leadership and oversight of ARB. As detailed above, the membership of the Board comprises of 15 members. Eight members are appointed (lay) members, who are appointed by the Privy Council after advice from the Secretary of State of the DCLG. Seven members are elected architect members. In relation to the appointed members, ARB is invited to identify particular skills which may be sought in making the appointments in order to assist the Board in securing a range of skills beneficial to the operation of the Board.

Members of the Board who served during the year are shown above in the Board Report.

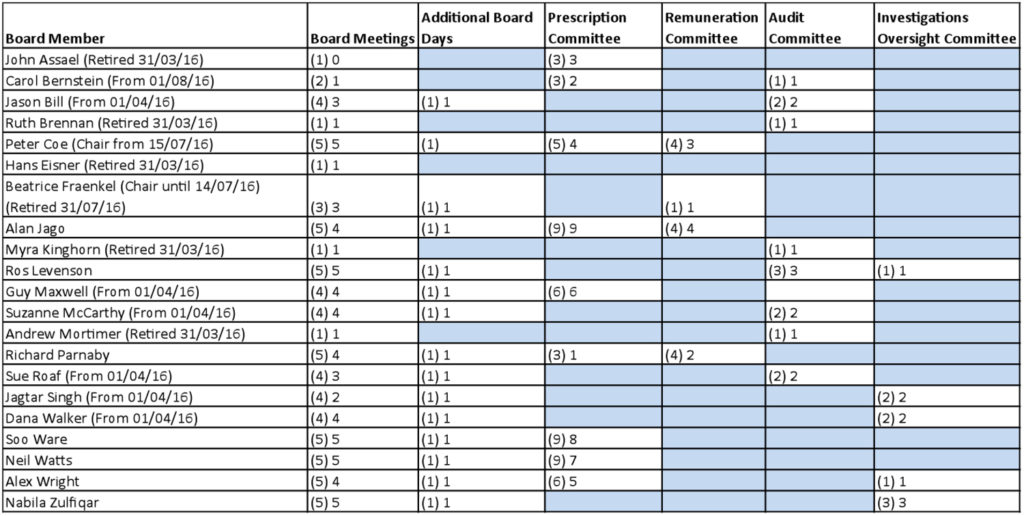

The Board met five times during 2016 and parts of each meeting were held in public. Agendas, papers and minutes were published on ARB’s website in accordance with ARB’s policy on open and confidential sessions of the meetings. Details of Board member attendance at Board and Committee meetings together with expenses and attendance allowances claimed are published annually and are reported on within these financial statements.

The Board works in accordance with a Board Members’ Handbook, which includes a Board Members’ Code, which follows the seven principles of public life.

Declarations of interests are collected at least annually and published on ARB’s website. At all meetings declarations are requested prior to commencement and, where appropriate, members are excluded from the relevant discussions. Declarations are recorded in the minutes.

Oversight

The Board determines ARB’s annual budget and ensures that the necessary resources are available to fulfil the statutory responsibilities. The Board provides oversight of the activities of ARB and sets the fees payable by architects for registration and retention of their names in the Register. Regular reviews are undertaken of ARB’s management accounts throughout the year and any variances are highlighted and considered. The Board receives a report on ARB’s performance against key performance indicators together with trend information twice a year, and considers mid-year progress of the Business Plan and the delivery of the Annual Business Plan after the year-end.

At each Board meeting the Board receives an operational activity report. The report provides the Board with information on the day-to-day operational business of the organisation.

Decisions of the Board

The Board is required to take a number of decisions under statute in addition to determining policy. Statutory decisions taken during 2016 included the prescription of new qualifications in architecture, introducing a new Architects’ Code of Conduct and setting the retention and other fees and the re-entry to the Register. In addition, the Board took non-statutory decisions such as the Scheme of Decision Making, the Investment Strategy and a review of the daily allowances paid to Board members and external advisers.

ARB has a number of Committees, which assist the Board, as shown below. Each Committee has terms of reference, which are determined by the Board and are published on ARB’s website. Each Committee reviews its own terms of reference and makes recommendations to the Board for change, with the exception of the Professional Conduct Committee, where the terms of reference are embedded within Rules. All Committees report to the Board. The Professional Conduct Committee holds its hearings in public and also provides an annual report to the Board. All other Committees prepare minutes, which are passed to the Board and also produce an annual report.

Audit Committee

The purpose of the Audit Committee is to assist the Board with its oversight functions. The Committee reviews the system of internal control, the management of risks and the financial reporting process. It also oversees the work of the internal and external auditors. This Committee is particularly important in assisting the Board and the Accounting Officer in managing risk.

Remuneration Committee

The purpose of the Committee is to ensure that the remuneration and reward packages offered to staff, Board members and advisers are reviewed and amended appropriately. Regular external benchmarking work is undertaken to ensure Board member attendance allowance rates and staff salaries remain in line with comparable organisations.

Investigations Oversight Committee

The Investigations Oversight Committee is in place to oversee investigations into allegations of unacceptable professional conduct and serious professional incompetence, as defined by section 14 of the Act. It monitors the performance of ARB and those appointed to investigate on its behalf and reports back to the Board through minutes of its meetings and an annual report.

Professional Conduct Committee

Although a Committee of ARB, the Professional Conduct Committee is separate from the Board in its decision-making. While a number of Board members are nominally members of the Committee, they take no part in cases being considered, to ensure a separation of policy making and decision making. The Professional Conduct Committee considers and determines cases referred for unacceptable professional conduct, serious professional incompetence and relevant criminal convictions. The Committee’s Chair presents a report on an annual basis, and attends the relevant Board meeting.

Prescription Committee

The Prescription Committee’s key role is to oversee the operation of the procedures for Prescription of Qualifications. It also considers and develops policies relating to the Prescription of Qualifications.

In addition, the Committee has a responsibility to oversee matters relating to ARB’s Prescribed Examinations and the Competency Standards Group.

Board Effectiveness

To assist the Board in the effective discharge of its responsibilities, Board members receive a comprehensive induction programme. Board and Committee papers are provided in advance of meetings, wherever possible, and contain sufficient information to allow the Board and the Committees to discharge their responsibilities. During the year, the Board also sets aside development sessions, which allow the Board to focus on horizon scanning and strategic development. A Board appraisal system is operated, together with an external appraisal process for the Chair of the Board. In 2016, in addition to feedback provided by individual Board members and the auditors, Committees also conducted their own effectiveness review. The Board considered the outcome of the most recent effectiveness review in February 2017, and will continue to take steps to improve Board and Committee effectiveness.

Risk Management

In fulfilling my responsibilities as both Accounting Officer and Registrar of the ARB, I work closely with the Board, as under the Architects Act 1997 (as amended) responsibilities for the delivery of the Act are designated to me or to the Board.

The Board determines the risk strategy of the organisation and sets the Scheme of Decision Making, which is in place to identify where authority for decision-making lies.

The Purpose of the System of Internal Control

The system of internal control is designed to manage risk to a reasonable level rather than to eliminate all risk of failure. It can therefore only provide reasonable and not absolute assurance of effectiveness. The system of internal control is an on-going process designed to identify and prioritise the risks to the achievement of ARB’s purpose and objectives, policies, objectives and statutory responsibilities. During 2016 specific consideration was given to the impact of the continuing Periodic Review, the possible implications of the EU referendum and the impact of the ongoing growth in the demand for the organisation’s services.

The system of internal control has been in place for the year ended 31 December 2016 and up to the date of approval of the annual report and financial statements. The system of internal control accords with Treasury guidance where it is considered to be appropriate and adds value to ARB.

Capacity to Handle Risk

The Board has overall responsibility for risk management and is aided by the Audit Committee. A fundamental aspect of risk management is obtaining assurance that appropriate systems of controls and actions are in place along with a robust and transparent reporting mechanism of those risks. The Board achieves this by having effective oversight procedures in place.

Along with the management team, I am responsible for the day-to-day management of risk including the delivery and promotion of sound risk management practices. Staff are aware of ARB’s Risk Strategy and are encouraged to contribute and highlight potential risks. Staff are regularly briefed on the content of the Risk Register and new actions and controls are added to the document accordingly.

The Risk and Control Framework

ARB has in place a risk management strategy, which is reviewed, updated and agreed by the Board annually. The strategy specifies how ARB identifies, assesses and manages risk that may impact on ARB’s delivery of its strategic aims, priorities and annual business plan. The strategy has six principles underpinning ARB’s approach, and it acknowledges that, as a statutory body, ARB is naturally risk-averse. ARB generally works to minimise and control risk by taking an appropriate and proportional approach to it.

ARB has a Risk Register in, which are logged and tracked risks faced by ARB. The Risk Register is a key tool within ARB’s Risk Management Framework. The Risk Register is reviewed at least monthly at management meetings. New risks are added, and consideration is given to the residual level of risk, identified after controls have been applied. The level of risk is adjusted where appropriate and some risks are removed. Actions and controls are also reviewed and amended as necessary according to the level of risk. Staff are invited to discuss and raise risks at monthly team meetings in order to embed a culture of risk ownership. A report is also taken to the Board at each of its meetings as part of the Registrar’s report on key risks.

ARB’s Risk Register has been divided into different risk categories: Governance Risk; Reputational Risk/Resource Risk; and Risk to Effective Delivery of Statutory Functions. Each risk level is then quantified using the likelihood and impact method. Controls are identified and actions put in place for each risk. A Risk Manager is assigned to the risk and a Risk Owner specified.

The Audit Committee has considered the key risks and developed, along with the Registrar and management team, a rolling programme of internal audit reviews conducted by ARB’s internal auditors. The Committee receives a report on the outcome of each review and monitors the implementation of any recommendations. In 2016, the internal audit programme covered Human Resources, Cyber Security and Investment Management.

The Committee monitors the progress of actions following internal audit reviews at each meeting and reports to the Board through its minutes as well as a verbal updates given by the Chair of the Committee. In addition to the internal audit programme, the management team undertook a series of internal compliance reviews, including compliance reviews of the ARB/DCLG Framework agreement and the Scheme of Decision Making.

Information and Data Security

ARB is committed to ensuring personal data held by the organisation is held securely and used appropriately and in line with that Data Protection principles. The organisation operates a range of measures to help safeguard personal and other data including:

- A commitment to data quality and accuracy;

- A regular reviewed and updated Retention & Destruction policy;

- A formal process for recording errors and omissions throughout the organisation, including procedural and data breaches. There were no significant data breaches during 2016 that required notification to the Information Commissioner;

- Data sharing agreements with those third parties with whom it is appropriate to share information;

- A “security shredding” contract with a trusted market leader;

- Industry-standard encryption of data for transfer and external storage;

- Regular information security training for staff;

- IT services policies and guidelines for staff;

- Statements on privacy, data protection, copyright and publishing;

- Compliance and monitoring tools for email, internet and telecommunication services and including social media;

- Physical security measures (including safe, access control systems and intruder alarm, CCTV recording equipment) both internally and at the perimeter;

- Off-site vaults and storage facilities with military-grade security for the storing of data

- ISO-certified destruction of information assets;

- Industry-standard firewall appliances to protect the organisation’s private network from attack and intrusion; and

- Network penetration testing for the protection of the organisation’s private network to be carried out annually and that testing includes the Remote Access system.

Risk Management Tools

Details of risk management tools are described in the sections above. In addition to those already mentioned, ARB also has in place:

- Appropriate insurance arrangements;

- Regular review of ARB’s Staff Handbook and associated appendices;

- External advisers used to ensure health and safety compliance;

- A log of complaints received with regard to ARB’s administrative processes and decisions;

- Errors log for procedures within ARB;

- Board and Committee papers for new or revised policies include an assessment of risk resource and equality implications;

- Staff and Board undertake horizon scanning of the organisation risk landscape

- Regular reviews of investment and reserves policies;

- Whistleblowing policy, Fraud and Bribery prevention policies are in place and regularly reviewed

- Staff training, including fire safety and information security training undertaken regularly;

- Regular reviews of operating procedures and an ethos of continuous improvement;

- Stringent budgeting process, linked to the annual Business Plan and three year forecasts;

- A Scheme of Delegated Authority, (Scheme of Decision Making) in place and is regularly reviewed and agreed by the Board;

- A financial procedures manual in place and regularly updated to reflect current practice

- Internal compliance reviews, undertaken of the Architects Act and ARB/DCLG Framework Agreement annually

As Accounting Officer, I attend all Board meetings, internal Management Team meetings and Audit Committee meetings. I also regularly attend other Committee meetings and meetings of the Remuneration Committee, where it is appropriate for me to do so.

Significant Risks in 2016

The key risk during 2016 was the impact, the on-going Periodic Review had on ARB’s ability to fulfil its statutory obligations effectively. This on-going uncertainty created the potential for the credibility of ARB to be undermined, delayed the commencement of some planned projects and increased the risks surrounding the retention and recruitment of staff.

Whilst managing the risks surrounding the Periodic Review the organisation continued to successfully deliver its statutory functions. Alongside the on-going challenges the delayed completion of Periodic Review 2016 saw an ongoing increase in the number of new applicants wishing to join the Register. The increased workload heightened the capacity and resource risk during 2016. This risk was mitigated by the use of temporary resources and the flexible approach and commitment of the staff, which enabled the organisation to continue to deliver its statutory functions during a period of increased demand.

There continues to be an ongoing risk in respect of judicial review or legal action in respect of decisions taken by the Board, the Registrar, or the Professional Conduct Committee. During 2016, an appeal was heard by the High Court against a decision of the Professional Conduct Committee. Although that appeal was dismissed in ARB’s favour, a further application to appeal that decision was made to the Court of Appeal. That application remains outstanding. Although all regulators may expect legal challenges to their decisions, such actions can be costly and increase reputational risk. ARB will continue to learn from all challenges and their outcomes, and regularly reviews its insurance arrangements to ensure that they are adequate, proportionate and appropriate.

Conclusions

As Accounting Officer, I have responsibility for reviewing the effectiveness of the system of internal control. My review is informed by the work of the management team within ARB who have responsibility for the development and maintenance of the internal control framework and comments made by both the internal and external auditors in their management letter and other reports.

Throughout the year the Audit Committee has continued to review the management of ARB’s risks, the work and outcomes of the completed internal and external audits, the timing for the implementation of recommendations made by the auditors and my review of the effectiveness of the system of internal control.

The tools used in ARB’s risk management are outlined in the risk and control framework above. I have identified no significant on-going weaknesses in the systems of internal controls, and welcome the continuing programme of internal audit and ARB’s commitment to continuously assess its procedures for quality, efficiency, and value for money.

Signed by

Karen Holmes, Registrar and Chief Executive (Accounting Officer)

12/05/2017

Remuneration and Staff Report

The Remuneration Committee was established in July 2009 following a review of ARB’s Governance and Committee structure. The purpose of the Committee is to ensure that the remuneration and reward package offered to all staff, Board members and advisers is reviewed and amended appropriately.

Regular external benchmarking work is undertaken to ensure Board member attendance allowance rates and staff salaries remain in line with comparable organisations.

From January to May 2016 the Remuneration Committee was made up of 3 Board members; Alan Jago (Chair), Beatrice Fraenkel and Susan Ware. From May 2016 the Committee comprised of Alan Jago, (Chair), Peter Coe and Richard Parnaby. Further information on attendance at these meetings can be found in the Board Allowances and Expenses Section below.

The Committee produces an annual report on its activities which is presented to the Board. This can be found at http://www.arb.org.uk/about-arb/arbs-board-committees/board-meetings/board-meetings-2017/february-agenda-16-02-2017/

ARB seeks to fairly remunerate employees, to motivate staff and to attract and maintain good quality staff. Staff commitment and good levels of engagement helps the organisation to deliver its objectives and business plan.

The composition of ARB staff and numbers at the end of the financial year was:

| 2016 | 2015 | |||

| Male | Female | Male | Female | |

| Registrar & Chief Executive | 0 | 1 | 0 | 1 |

| Permanent Staff | 7 | 10 | 7 | 9 |

| Fixed Term / Temporary | 1 | 2 | 1 | 2 |

| TOTAL Split | 8 | 13 | 8 | 12 |

| TOTAL Employees | 21 | 20 | ||

ARB’s Staff Policies

ARB’s aim is to have a workforce that is truly representative of all sections of society where each employee feels respected and able to give their best. Selection for employment, promotion, training or any other benefit is on the basis of aptitude and ability. We help and encourage all our employees to develop their full potential, and their talents and resources are fully utilised to maximise the efficiency of the organisation.

In order to achieve this, all job descriptions are carefully drafted to ensure that the skills and knowledge reflect the job requirements and do not place unnecessary restrictions on applicants. Applicants are invited to complete an Equalities Monitoring form at the application stage, which is received separately to the application form and is not available to the short-listing panel. All applicants are invited to provide details of any disability in order that reasonable adjustments can be made for the selection process. Equality Monitoring forms are analysed in respect to steps that can be taken to further equality and inclusion.

ARB continues to be supportive of staff with disabilities and appreciates the value that all employees bring to their roles. Regular one-to-one meetings and performance reviews provide the opportunity to identify the need for adjustments for disabled staff in employment as well as reviewing those adjustments to ensure they continue to be relevant.

Management takes proactive steps to promote a culture that understands, accepts and supports both physical and mental disabilities in the workplace. Incorporated in the annual training plan, equalities training is one of the ways that management seeks to re-enforce diversity. HR policies and practices further support the employment of staff with disabilities. The wellbeing of disabled and able bodied staff is supported by the range of benefits offered by the organisation.

Staff training needs are identified at performance appraisals when development needs are assessed and prioritised. Training opportunities are prioritised on the basis of relevance to an individual’s role and their career path. Any training or development interventions for staff with disabilities are prioritised. Opportunities for promotion are advertised internally for two weeks before a decision is made about advertising externally. All internal applicants meeting the essential criteria are interviewed and any relevant adjustments made. All internal applicants are given feedback on the selection process and any development needs incorporated into personal development plans.

Remuneration

The Remuneration Committee, annually benchmarks rates of pay awards given by our competitors as well as looking at employment market trends. The Committee also give consideration to Governments expectations on public sector pay awards. The pay award given to all staff for 2016 was 1%, which was in line with Government expectations. The Committee can also make non-consolidated incentive payments to staff. This is dependent on delivery of the Business Plan and a decision is taken each year. During 2016, there were no changes to ARB’s remuneration policy.

Reporting bodies are required to disclose the relationship between the remuneration of the highest-paid employee in their organisation and the median remuneration of the organisation’s workforce. Total remuneration includes salary, non-consolidated performance-related pay and benefits-in-kind. It does not include severance payment or employer pension contributions.

The mid-banded remuneration of the highest paid employee of ARB in the financial year end 2016 was £118,000 (2015, £107,500). This is 3.26 times (2015 3.17 times) the median remuneration of the workforce, which was £36,213 (2015, £37,033).

Note 6 of the Financial Statements notes provides details of the highest paid members of staff and the contributions paid by ARB into their Defined Contribution (DC) pension fund during 2016.

Staff Turnover

Staff turnover for 2016 was 14% (10% 2015). The figure for ARB staff turnover is higher than the national average across all sectors. However, with such a low number of staff, any departures and recruitment has a significant statistical impact.

Staff Absence Information

The number of days lost through sickness absence for the 19.8 full time employees was 56.5 days (54 in 2015). This is equivalent to 2.8 days per employee, the same as in 2015.

Staff Pension Arrangements

ARB provides its employees with access to a contributory Group Personal Pension Scheme (otherwise known as a Defined Contribution – DC – arrangement). ARB’s liability for this arrangement ceases when employment comes to an end.

This arrangement meets all statutory requirements for employment law relating to employer sponsored pension arrangements.

Additionally, ARB has a closed (Paid Up) Occupational Money Purchase scheme (which is also a defined contribution arrangement). There are, however, no contributions being made to this scheme and nor have there been for several years. There are no liabilities for future contributions to this scheme.

Note 6 of the Financial Statements notes provides details of the highest paid members of staff and the contributions paid by ARB into the Group Personal Pension Scheme during 2016.

Professional and Specialist Services

ARB often needs day-to-day specialist advice such as for the interpretation of EU law, employment advice, IT, insurance and legal challenges. Due to the broad ranging spectrum of advice required and to use our resources as efficiently as possible, we procure such services from a small number of suppliers, as and when required. Further information on this spend can be found under note 10 of the Financial Statements.

Board Remuneration Report

The Remuneration Committee each year considers the remuneration of Board members, panel members and advisers, including travel and subsistence payments on an annual basis. The Board, based on a recommendation from the Remuneration Committee, takes the final decision.

Board members received an attendance allowance of £250 (held since July 2010) per day for attending Board meetings and participating in other Board business and Committees. Reading time for meetings was extended to cover all Board and Committee meetings from 1 December 2016.

The total attendance and reading allowances paid during 2016 were £66,978 (2015: £52,395), which includes allowances paid to Board members for their roles as members of other Committees.

Board members are also able to claim travel and subsistence expenses. Expenses totalling £17,008 (2015: £14,251) were claimed during the year.

There were five Board meetings held during 2016. The average attendance at each meeting was 13 Board members.

Further details can be found in the Board Allowances and Expenses Section below.

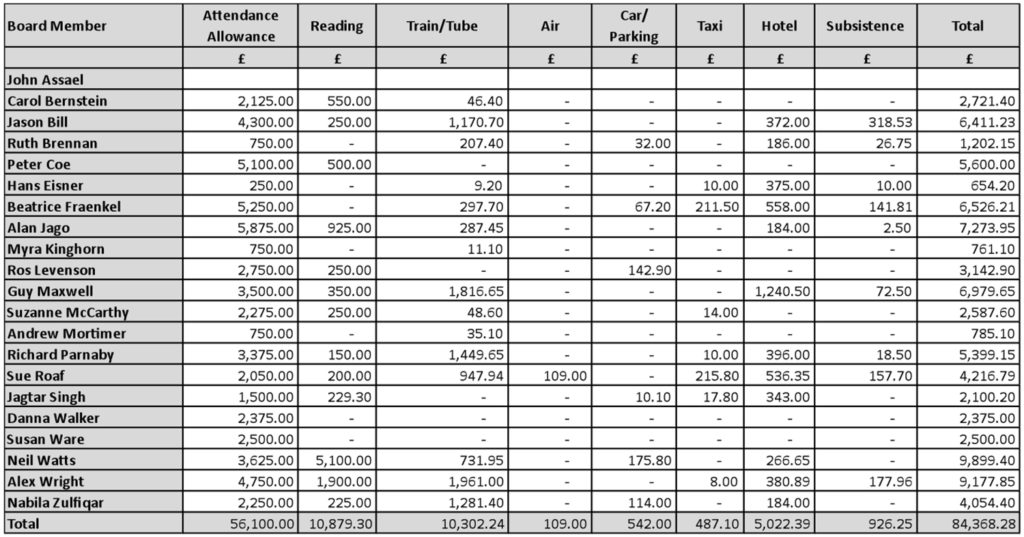

A summary of Board and Committee attendance allowance and expenses paid in 2016:

| Amount | Number of Board Members |

| Less than £1k | 4 |

| £1k less than £6k | 11 |

| £6k less than £10k | 6 |

Signed by:

Karen Holmes, Registrar and Chief Executive (Accounting Officer)

12/05/2017

INDEPENDENT AUDITOR’S REPORT TO THE BOARD MEMBERS OF THE ARCHITECTS REGISTRATION BOARD

We have audited the financial statements of the Architects Registration Board for the year ended 31 December 2016 which comprise the Statement of Comprehensive Income, Statement of Financial Position, Statement of Cash flows, Statement of Changes in Reserves and related notes numbered 1 to 25.

The financial reporting framework that has been applied in their preparation is applicable law and the 2016/17 Government Financial Reporting Manual (FReM) which applies International Financial Reporting Standards as adopted by the European Union (IFRSs).

This report is made solely to the Board Members of the Architects Registration Board, as a body, under the Architects Act 1997. Our audit work has been undertaken so that we might state to the Board Members those matters we are required to state to them in an auditor’s report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the Architects Registration Board and the Board Members as a body, for our audit work, for this report, or for the opinions we have formed.

Respective responsibilities of the Board, Accounting Officer and auditor

As explained more fully in the Statement of the Board’s and Accounting Officer’s responsibilities, the Board and Accounting Officer are responsible for the preparation of the financial statements and for being satisfied that they give a true and fair view. Our responsibility is to audit and express an opinion on the financial statements in accordance with applicable law and International Standards on Auditing (UK and Ireland). Those standards require us to comply with the Auditing Practices Board’s Ethical Standards for Auditors.

Scope of the audit of the financial statements

An audit involves obtaining evidence about the amounts and disclosures in the financial statements sufficient to give reasonable assurance that the financial statements are free from material misstatement, whether caused by fraud or error. This includes an assessment of: whether the accounting policies are appropriate to the Architects Registration Board’s circumstances and have been consistently applied and adequately disclosed; the reasonableness of significant accounting estimates made by the Architects Registration Board; and the overall presentation of the financial statements.

In addition, we read all the financial and non-financial information in the Board’s Report and any other surround information to identify material inconsistencies with the audited financial statements and to identify any information that is apparently materially incorrect based on, or materially inconsistent with, the knowledge acquired by us in the course of performing the audit. If we become aware of any apparent material misstatements or inconsistencies we consider the implications for our report.

Opinion on financial statements

In our opinion, the financial statements:

- give a true and fair view of the state of the Architects Registration Board’s affairs as at 31 December 2016 and of its surplus for the year then ended;

- have been properly prepared in accordance with the Government Financial Reporting Manual (FReM).

Crowe Clark Whitehill LLP

Statutory Auditor

London

ARCHITECTS REGISTRATION BOARD

STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED 31 DECEMBER 2016

| Notes | 2016 | 2015 | ||

| £ | £ | £ | ||

| OPERATING INCOME | ||||

| Registration and retention fees | 3 | 4,240,817 | 4,051,035 | |

| Prescribed examinations | 209,768 | 248,602 | ||

| Penalties and sundry receipts | 4 | 22,988 | 37,898 | |

| Investment income | 5 | 116,179 | 79,925 | |

| Total operating income | 4,589,752 | 4,417,460 | ||

| EXPENDITURE | ||||

| Employee salaries and benefits | 6 | 1,368,788 | 1,223,276 | |

| Office costs | 7 | 621,058 | 474,943 | |

| 1,989,846 | 1,698,219 | |||

| Printing and records | 8 | 53,693 | 52,860 | |

| IT charges | 9 | 395,369 | 309,734 | |

| Board allowances and expenses | 74,717 | 53,853 | ||

| Legal and other professional charges | 10 | 999,551 | 953,549 | |

| Other administrative expenses | 11 | 292,255 | 304,182 | |

| 1,815,585 | 1,674,178 | |||

| Total operating expenditure | 3,805,431 | 3,372,397 | ||

| OPERATIONAL SURPLUS FOR THE YEAR | 784,321 | 1,045,063 | ||

| Net gains / (losses) on investments | 375,934 | (100,457) | ||

| SURPLUS FOR THE YEAR BEFORE TAXATION | 1,160,255 | 944,606 | ||

| Taxation | 19 | (80,188) | 31,736 | |

| RETAINED SURPLUS FOR THE YEAR | 1,080,067 | 976,342 | ||

| RESERVES AT THE START OF THE YEAR | 3,901,039 | 2,924,697 | ||

| RESERVES AT THE END OF THE YEAR | 4,981,106 | 3,901,039 | ||

There are no recognised gains and losses other than those included above. All activities are continuing.

ARCHITECTS REGISTRATION BOARD

STATEMENT OF FINANCIAL POSITION

AT 31 DECEMBER 2016

| Notes | 2016 | 2015 | |

| £ | £ | ||

| NON-CURRENT ASSETS | |||

| Property, plant and equipment | 12 | 169,256 | 209,493 |

| Intangible assets | 13 | 132,599 | 126,638 |

| Investments | 14 | 5,716,910 | 4,137,901 |

| Total non-current assets | 6,018,765 | 4,474,032 | |

| CURRENT ASSETS | |||

| Trade and other receivables | 15 | 496,480 | 185,149 |

| Cash and cash equivalents | 2,869,748 | 3,198,764 | |

| Total current assets | 3,366,228 | 3,383,913 | |

| TOTAL ASSETS | 9,384,993 | 7,857,945 | |

| CURRENT LIABILITIES | |||

| Trade and other payables | 16 | 381,809 | 308,658 |

| Deferred income | 4,022,078 | 3,648,248 | |

| Total current liabilities | 4,403,887 | 3,956,906 | |

| ASSETS LESS LIABILITIES | 4,981,106 | 3,901,039 | |

| RESERVES | |||

| Designated reserve | 103,000 | 114,000 | |

| Operational reserve | 4,609,026 | 3,654,047 | |

| Revaluation reserve | 269,080 | 132,992 | |

| TOTAL RESERVES | 4,981,106 | 3,901,039 |

These financial statements were approved by the Board and Accounting Officer and authorised for issue on

Board member

Board member

Board member

Board member

Accounting officer

Accounting officer

ARCHITECTS REGISTRATION BOARD

STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED 31 DECEMBER 2016

| 2016 | 2015 | |||

| £ | £ | £ | ||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||

| Operational surplus for the year | 784,321 | 1,045,063 | ||

| Adjustments for non-cash transactions | ||||

| Depreciation and amortisation | 180,612 | 180,084 | ||

| Changes in operating assets and liabilities | ||||

| (Increase) in trade and other receivables | (311,331) | (32,481) | ||

| Increase in trade, other payables and | ||||

| deferred income | 446,981 | 224,533 | ||

| Net cash from operating activities | 316,262 | 372,136 | ||

| CASH FLOWS FROM INVESTMENT ACTIVITIES | ||||

| Proceeds from the sale of investments | 2,288,133 | 1,613,039 | ||

| Purchase of investments | (3,491,208) | (2,652,381) | ||

| Purchases of property, plant and equipment and | ||||

| intangible assets | (146,336) | (132,051) | ||

| Net cash decreases from investing activities | (1,349,411) | (1,171,393) | ||

| Taxation | (80,188) | 31,736 | ||

| Net (decrease) / increase in cash and cash equivalents | (329,016) | 277,542 | ||

| Cash and cash equivalents at the start of the year | 3,198,764 | 2,921,222 | ||

| Cash and cash equivalents at the end of the year | 2,869,748 | 3,198,764 | ||

All cash is represented by cash in hand

ARCHITECTS REGISTRATION BOARD

STATEMENT OF CHANGES IN RESERVES

AT 31 DECEMBER 2016

| Designated

Reserve |

Operational

Reserve |

Revaluation

Reserve |

Total

Reserves |

||||

| £ | £ | £ | £ | ||||

| Balance at

1 January 2016 |

114,000 | 3,654,047 | 132,992 | 3,901,039 | |||

| Movement for the year | – | 943,979 | 136,088 | 1,080,067 | |||

| Transfer between reserves | (11,000) | 11,000 | – | – | |||

| Balance at

31 December 2016 |

103,000 | 4,609,026 | 269,080 | 4,981,106 | |||

At 31 December 2016, designated reserves represented the IT renewal fund (£42,000 – to cover the cost of ensuring that the organisation’s computer systems remain up to date and efficient), the Election Fund (£20,000 – set up to cover the cost of the triennial election of ARB Board) and the Maintenance Reserve (£41,000 – set up to cover the regular cost of redecoration of the offices in accordance with the terms of the lease).

At the 31 December 2015, the revaluation reserve represented the closing market value less historic cost value of ARBs investments (accumulated unrealised gains).

ARCHITECTS REGISTRATION BOARD

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2016

1. GENERAL INFORMATION

The Architects Registration Board is incorporated under the Architects Act 1997. ARB’s principal address is shown at the top of the page. ARB’s principal activity is acting as the statutory regulator for architects in the UK. The ARB is an arms-length body overseen by the Department for Communities and Local Government (DCLG).

2. ACCOUNTING POLICIES

a) Basis of accounting

The financial statements have been prepared in accordance with International Financial Reporting Standards (IFRS) as adopted and interpreted by the 2016-17 Government Financial Reporting Manual (FReM) issued by HM Treasury.

Where the FReM permits a choice of accounting policy, the accounting policy which is judged to be most appropriate to the particular circumstances of the ARB for the purpose of giving a true and fair view has been selected. The particular policies adopted by the ARB are described below. They have been applied consistently in dealing with items that are considered material to the financial statements.

These financial statements have been prepared under the historical cost convention modified to account for the revaluation of investments. Figures are presented in pounds sterling, which is the functional currency of the ARB and rounded to the nearest pound. Transactions denominated in foreign currencies are translated into sterling at the exchange rate at the dates of the transactions.

After making enquiries, the ARB has a reasonable expectation that the organisation will be able to continue its activities for the foreseeable future. Accordingly they continue to adopt the going concern basis in preparing the financial statements.

b) Impending application of newly issued accounting standards not yet effective

The ARB discloses wherever it has not yet applied a new accounting standard, and provides any information relevant to assessing the possible impact that the initial application of the new standard would have on the financial statements. There were no new standards issued at the date of reporting that are required to be applied by the ARB.

c) Staff costs

In accordance with IAS 19 Employee Benefits, all short-term staff costs payable at the year-end, which will be paid within one year from the date of reporting, are recognised in the Statement of Comprehensive Net Expenditure.

d) Pensions

The ARB operates a defined contribution pension scheme where the ARB pays established annual contribution rates into a separate fund. The amount of pension benefit that a member receives in retirement is dependent on the performance of the fund. The ARB recognises the cost of these contributions in the Statement of Comprehensive Income when they fall due. There are no further payment obligations for the ARB once the contributions have been paid.

e) Leases

Payments in relation to operating leases (excluding costs for services such as insurance and maintenance) are charged to the Statement of Comprehensive Income on a straight-line basis.

f) Value Added Tax on purchases

The ARB is unable to recover the VAT it pays on its expenditure due to the VAT status of its suppliers. Therefore, all expenditure disclosed in the financial statements includes any VAT paid.

g) Income

Income is recognised to the extent that it is probable that the economic benefits will flow to ARB and the revenue can be reliably measured. Income is measured at the fair value of the consideration received. Income arising from the provision of services is recognised when and to the extent that ARB obtains the right to consideration in exchange for the performance of its contractual obligations.

Retention fees are recognised in the period over which they entitle an individual to be listed on the Register of Architects. Registration, penalties and prescribed examination fees are recognised in the year in which the registration or prescribed examination takes place or that the penalty becomes due. Income from investments and cash is recognised in the period in which the ARB becomes entitled to the income.

h) Corporation tax

The ARB is liable for tax on income earned and gains on investments during the year. The tax expense is recognised in the Statement of Comprehensive Income.

i) Plant, equipment and intangible assets

Expenditure of £500 or more on plant and equipment or intangible assets is capitalised where it is expected to bring benefit over future years. On initial recognition, assets are measured at cost and include all costs directly attributable to bringing them into working condition.

All non-current assets are reviewed annually for impairment. Plant and equipment is depreciated, and intangible assets amortised from the time the item comes into operational use, at rates calculated to write them down to the estimated residual value on a straight-line basis over their estimated useful lives. The following annual rates are used:

Leasehold improvements – over 10 years

Office furniture and equipment – over 5 years

IT equipment – over 3 years

IT development – over 3 years

j) Cash and cash equivalents

Cash and cash equivalents comprise cash at bank and in hand and short-term deposits with maturity dates of three months or less.

k) Investments

Investments comprise holdings of a number of Gilts (UK Sovereign debt), Corporate Bonds and Equity funds managed by separate investment managers. The fair value of the investments is based on the closing market value at the accounting date. Gains and losses arising from changes in market value are included within the Statement of Comprehensive Income.

l) Trade and other payables

Trade payables are obligations on the basis of normal credit terms and do not bear interest. They are categorised as financial liabilities at amortised cost.

| 3. REVENUE – REGISTRATION AND RETENTION FEES | ||

| 2016 | 2015 | |

| £ | £ | |

| Registration fees | 137,606 | 145,966 |

| Retention fees | 4,103,211 | 3,905,069 |

| 4,240,817 | 4,051,035 |

| 4. REVENUE – PENALTIES AND SUNDRY RECEIPTS | ||

| £ | £ | |

| Penalties paid on reinstatement to the Register | 10,990 | 29,752 |

| Sundry receipts | 11,998 | 8,146 |

| 22,988 | 37,898 |

| 5. INVESTMENT INCOME | ||

| Income from investment portfolio | 105,483 | 71,845 |

| Interest on bank deposits | 10,696 | 8,080 |

| 116,179 | 79,925 | |

| 6. STAFF COSTS | ||

| Wages and salaries | 985,805 | 899,229 |

| Social security | 116,496 | 105,297 |

| Other pension costs | 109,669 | 93,595 |

| Medical and permanent health insurance | 30,253 | 32,107 |

| Recruitment costs | 29,152 | 8,273 |

| Staff training | 16,176 | 20,925 |

| Temporary staff | 81,237 | 63,850 |

| 1,368,788 | 1,223,276 | |

| No. | No. | |

| Staff numbers (average full time equivalent permanent staff) | 21 | 20 |

Salaries in respect of those employees paid over £62k were within the following ranges:

| No. | No. | |

| £75,000 – £79,999 | 3 | 2 |

| £115,000 – £119,999 | 1 | 1 |

Payments were made into defined contribution pension schemes totalling £43,965 (2015: £31,556) in respect of these employees.

| 7. OFFICE COSTS | 2016 | 2015 |

| £ | £ | |

| Rent & Service Charges | 282,715 | 163,597 |

| Rates | 114,776 | 97,658 |

| Building related costs | 65,886 | 56,044 |

| Insurance | 7,955 | 6,170 |

| Electricity | 14,761 | 18,572 |

| Office cleaning | 24,326 | 24,706 |

| Postage and telephone | 44,407 | 43,707 |

| Maintenance of office equipment | 12,124 | 10,853 |

| Depreciation: leasehold improvements | 51,732 | 51,733 |

| Depreciation: furniture and equipment | 2,376 | 1,903 |

| 621,058 | 474,943 | |

| 8. PRINTING AND RECORDS | ||

| Printing | 46,265 | 44,022 |

| Stationery | 6,303 | 6,560 |

| Journals and newspapers | 1,125 | 2,278 |

| 53,693 | 52,860 | |

| 9. IT CHARGES | ||

| Depreciation and amortisation: IT equipment and development | 126,506 | 126,448 |

| IT costs | 268,863 | 183,286 |

| 395,369 | 309,734 | |

| 10. LEGAL AND OTHER PROFESSIONAL CHARGES | ||

| Remuneration to external auditors: | ||

| External audit services | 19,080 | 18,720 |

| Other services – corporation tax compliance advice | 1,260 | 1,230 |

| – employment tax advice | 828 | 786 |

| Legal expenses and professional charges – regulation | 724,541 | 682,652 |

| General legal, specialist advice and insurance | 253,842 | 250,161 |

| 999,551 | 953,549 | |

Remuneration to external auditors shown above is inclusive of VAT. Excluding VAT external audit fees were £15,900, fees for corporation tax compliance were £1,050 and fees for employment tax compliance advice were £690.

| 11. OTHER ADMINISTRATION EXPENSES | 2016 | 2015 |

| £ | £ | |

| Bank charges | 43,186 | 53,174 |

| Staff travel expenses | 14,659 | 13,936 |

| Prescribed examination | 92,224 | 112,537 |

| Prescription & Qualifications | 56,113 | 48,952 |

| ACE & ENACA | 37,610 | 33,549 |

| Public and professional awareness | 36,176 | 33,405 |

| Sundry expenditure | 12,287 | 8,629 |

| 292,255 | 304,182 |

| 12. PLANT AND EQUIPMENT | Leasehold | Office furniture | ||

| improvements | & equipment | IT equipment | Total | |

| £ | £ | £ | £ | |

| Cost | ||||

| At 1 January 2016 | 517,325 | 109,421 | 250,820 | 877,566 |

| Additions | – | 2,365 | 60,574 | 62,939 |

| Disposals | – | – | – | – |

| At 31 December 2016 | 517,325 | 111,786 | 311,394 | 940,505 |

| Accumulated depreciation | ||||

| At 1 January 2016 | 362,128 | 105,659 | 200,286 | 668,073 |

| Charge for the year | 51,732 | 2,376 | 49,068 | 103,176 |

| Disposals | – | – | – | – |

| At 31 December 2016 | 413,860 | 108,035 | 249,354 | 771,249 |

| Carrying amount | ||||

| At 31 December 2016 | 103,465 | 3,751 | 62,040 | 169,256 |

| At 31 December 2015 | 155,197 | 3,762 | 50,534 | 209,493 |

| 13. INTANGIBLE ASSETS | Total | |||

| £ | ||||

| Cost | ||||

| At 1 January 2016 | 421,440 | |||

| Additions | 83,397 | |||

| At 31 December 2016 | 504,837 | |||

| Accumulated depreciation | ||||

| At 1 January 2016 | 294,802 | |||

| Charge for the year | 77,436 | |||

| At 31 December 2016 | 372,238 | |||

| Carrying amount | ||||

| At 31 December 2016 | 132,599 | |||

| At 31 December 2015 | 126,638 | |||

| Intangible assets include capitalised IT development and software |

| 14. INVESTMENTS | ||

| 2016 | 2015 | |

| £ | £ | |

| At market value | ||

| At start of year | 4,137,901 | 3,199,016 |

| Additions | 3,491,208 | 2,652,381 |

| Disposal proceeds | (2,288,133) | (1,613,039) |

| Net gains on investments | 375,934 | (100,457) |

| At end of year | 5,716,910 | 4,137,901 |

| Cost at end of year | 5,447,830 | 4,004,910 |

All investments are managed by Quilter Cheviot and are invested in a mixture of Gilts (UK Sovereign debt), Corporate Bonds and Equity funds.

| 15. TRADE AND OTHER RECEIVABLES | ||

| £ | £ | |

| Other receivables (employee season ticket loans) | 17,965 | 21,264 |

| Cash in Transit | 321,244 | 4,352 |

| Prepayments | 157,271 | 141,058 |

| Corporation Tax | – | 18,475 |

| 496,480 | 185,149 | |

Cash in transit relates to credit card payments taken but not transferred over to ARB bank account by the merchant at the year end. All cash in transit was received in ARBs bank account in January 2017. There are no impaired financial assets.

| 16. TRADE AND OTHER PAYABLES | ||

| £ | £ | |

| Trade payables | 41,527 | 48,719 |

| Corporation tax | 60,621 | – |

| Other taxation and social security | 60,009 | 58,913 |

| Accruals | 219,652 | 201,026 |

| 381,809 | 308,658 | |

It is ARB’s policy to pay purchase invoices within 30 days of receipt.

17. PENSIONS

The Staff Pension Scheme is a defined contribution scheme. The cost of contributions during the period was £109,669 (2015: £93,595). There are no outstanding or prepaid contributions at the balance sheet date. The assets of the scheme are held separately from those of the Architects Registration Board in an independently administered fund.

18. LEASING COMMITMENTS

The Architects Registration Board is committed to making the following minimum annual payments under operating leases, which expire:

| Land and buildings | ||

| 2016 | 2015 | |

| £ | £ | |

| Between one and five years | 598,282 | 864,185 |

The Architects Registration Board is committed to the lease on its Weymouth Street premises until April 2019.

19. TAX EXPENSE

ARB is a mutual trading organisation and is therefore taxed only on outside sources of income. Historically this has been investment income and gains. Corporation tax was calculated at 20% of investment income and gains on investments during the period.

20. RELATED PARTY TRANSACTIONS – ARCHITECTS REGISTRATION BOARD STAFF BENEVOLENT FUND

The Architects Registration Board is able to appoint the trustees of the Architects Registration Board Staff Benevolent Fund. At 31 December 2016 all trustees of the Fund were members of the Board of the Architects Registration Board. The cost of the Fund’s audit together with other administration expenses is met by the Architects Registration Board.

21. CURRENCY RISK

ARB does not hold balances in foreign currencies. All fees payable are required to be settled in UK sterling and so ARB is not exposed to current risk.

22. LIQUIDITY AND CREDIT RISK

ARB aims to maintain a minimum of four months operating costs as a reserve, and reserves during the year to 31 December 2016 were in excess of this level. As stated above, the majority of ARB’s income is received at the start or before the start of the financial year. ARB has no borrowings (or legal right to borrow) and monies required for short-term working capital requirements are held in accounts with no significant restrictions on access. ARB does not consider that there is a significant exposure to liquidity or credit risk.

24. INTEREST RATE RISK

Registrants pay annual fees at the start or prior to the start of each financial year. In addition ARB has reserves equating to around five months’ annual expenditure. Surplus funds are held as follows to maximise returns:

Funds not required for short-term working capital are held in Gilts (UK Sovereign debt), Corporate Bonds and Equity funds. The return for the last year is at 8.0% versus the benchmark’s 9.8%. It is a greater return than the previous year and significantly higher than funds on deposit would have achieved.

Business reserve – There is a sweeping system in operation from ARB’s current account to the business reserve in order to maximise interest earned on monies needed for short-term working capital requirements.

Treasury reserve – Monies not required for short-term working capital are invested in higher interest accounts with ARB bankers.

25. RESERVES

The Board’s reserves policy is to:

- Hold a minimum of the estimated wind-up costs, assessed annually. When calculating this figure, unrealised profit on investments will be included.

- The operating reserves fund should not drop below four months’ operating costs

At the end of the 2016 financial year, the level of reserves was sufficient to cover the estimated wind up costs, as required by the framework agreement with the DCLG. The Board is due to review its policy in September 2017.

ARCHITECTS REGISTRATION BOARD

YEAR ENDED 31 DECEMBER 2016

BOARD ALLOWANCES AND EXPENSES

Board Members Expenses and Meeting Attendance

The costs below include attendance allowances and expenses relating to members of the Board who are also members of other Committees for their attendance at those meetings.

Attendance

(Actual number of meetings held) compared with actual meetings attended

Notes:

- More than one meeting may occur during a day, in which case the amount charged will not reflect the number of meetings

- Some members do not charge the full daily rate for meetings

- Board members, from time to time, attend other meetings on ARB business – such as appraisals, induction sessions and visits for new members

- Committee memberships changed during the years as a result of new Board members joining